U.S. Stocks Rise to Records, Bonds Gain on ECB Stimulus Optimism

by- ECB seen extending bond-buying program in decision Thursday

- Trump comments on drug prices send biotech shares lower

U.S. Stocks Edge Towards Record, What's Next?

The Dow Jones Industrial Average rose 220 points as U.S. stock indexes powered to all-time highs after an easing of the bond selloff boosted dividend-yielding equities. Treasuries fell with European debt as speculation mounted that the region’s central bank will prolong its asset-buying program.

The 30-member blue-chip index jumped to a record as phone and REIT shares joined the post-election rally that’d been led by cyclical shares. Biotechnology companies in the S&P 500 Index tumbled the most since October after Donald Trump declared himself an opponent of high drug prices. European equities advanced for a third day. Bonds rose across the euro area, with the yield on the benchmark German bund falling from the highest in almost three weeks. Treasuries slipped and crude fell toward $50 a barrel in New York.

U.S. stocks had been struggling to add to a post-election rally that took major indexes to all-time highs in late November amid a selloff in bonds that weighed on large parts of the equity market. That’s reversed Wednesday, as investors are positioning for an extension of monthly asset purchases of 80 billion euros ($86 billion) by the ECB past March even as uncertainty lingers before the bank concludes two days of meetings Thursday.

Stocks

- The S&P 500 Index rose 0.9 percent to 2,232.05 at 1:54 p.m. in New York, on track for a record close. The Dow Jones Industrial Average added 256.81 points to 19,508.59, a fresh all-time high.

- REITs and phone stocks added 2.3 percent. They tend to rise when Treasuries gain and yields fall.

- Health-care shares slid 0.9 percent, the only of 11 groups to retreat. Pfizer Inc. fell 1.2 percent for the steepest slide in the Dow. Biotech stocks plunged 2.4 percent.

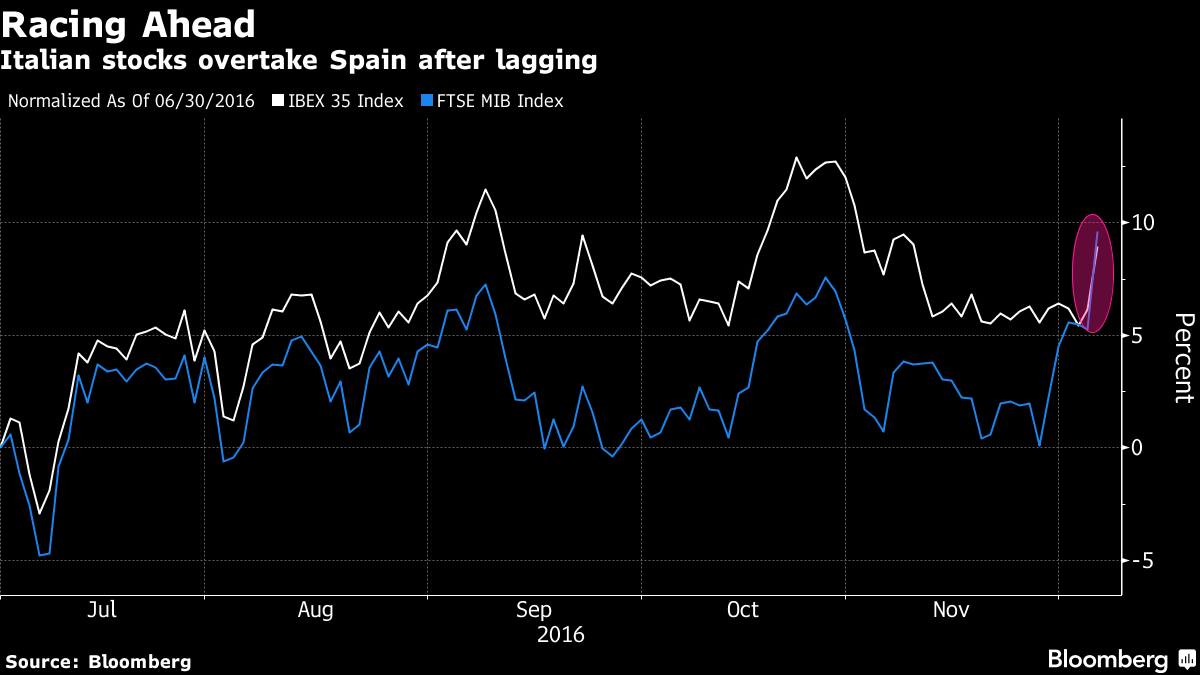

- The Stoxx Europe 600 Index added 0.9 percent as mining companies and banks rallied

- Credit Suisse Group AG gained 6.4 percent, while Banca Monte dei Paschi di Siena SpA rose 8.7 percent after La Stampa reported Italy will ask for a 15 billion euro ESM loan for the lender, among other banks.

- Japan’s Topix index gained 0.9 percent in Tokyo as the MSCI Asia Pacific Index added 0.4 percent.

Bonds

- Germany’s 10-year bond yield fell three basis points to 0.33 percent, after climbing to 0.38 percent, the highest since Nov. 14. The government sold 2.6 billion euros out of a planned 3 billion euros of 2018 securities.

- Italian sovereign debt securities due in a decade advanced for a second day, almost erasing losses suffered in the aftermath of Sunday’s referendum. The nation’s 10-year bond yield fell five basis points to 1.89 percent, adding to a four-basis point drop from Tuesday.

- Portugal’s 10-year bond yield reached the lowest level since Nov. 15.

- Treasury 10-year note yields were little changed at 2.36 percent.

- The Markit iTraxx Europe Index of credit-default swaps on investment-grade companies dropped one basis point to 74 basis points, the lowest since Nov. 9. A gauge of swaps on junk-rated companies fell to a three-month low.

Commodities

- Oil fell 1 percent to $50.42 a barrel amid speculation a production boost from U.S. shale producers will counter the first output cuts from OPEC in eight years.

- Copper gained 0.5%, recouping an earlier decline. Steel rebar in China climbed with iron ore to the highest in more than two years, as reports of a crackdown on illegal plants spurred speculation that the government is stepping up supply-side reforms.

- Spot gold was little changed at $1,173.72 an ounce.

Currencies

- The pound dropped 0.5 percent to $1.2611 after industrial production in October fell 1.3 percent, driven by a slide in oil and gas extraction.

- The euro was little changed at $1.0725 after posting a 0.4 percent drop on Tuesday.

- Overnight volatility in the common currency versus its U.S. counterpart jumped to 23 percent, the most since June 23, based on closing prices

- The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, was little changed